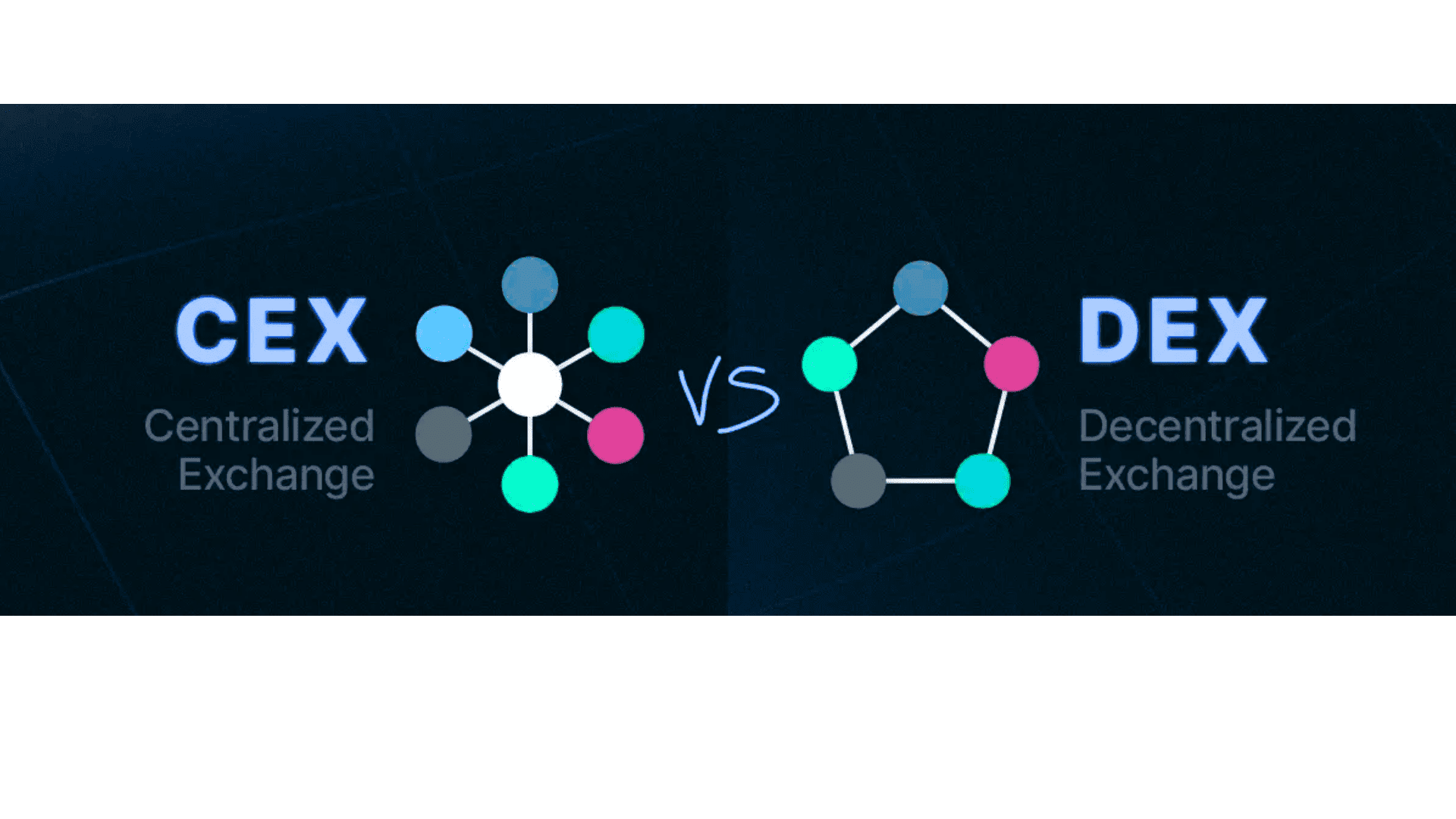

Difference Between CEX and DEX

In the world of cryptocurrency trading, two major types of exchanges dominate: Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). While both serve the same primary function — facilitating cryptocurrency trading — they do so in very different ways.

Let’s break down the key differences between these exchanges to help you understand which one suits your needs better.

1. What is a Centralized Exchange (CEX)?

A Centralized Exchange (CEX) is a platform controlled by a central authority or company. These exchanges act as intermediaries between buyers and sellers, managing the order book, custody of funds, and transaction execution.

Key Features of CEX:

Centralized control: A single entity manages the platform.

User funds stored: The exchange holds the funds in its own wallets.

Higher liquidity: Centralized control means more liquidity and faster trades.

User-friendly interface: Easier for beginners.

Regulation: Often operates under the regulations of a specific country.

Examples of CEX:

Binance

Coinbase

Kraken

KuCoin

- Gate.io

- Crypto.com

What is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX), on the other hand, is a platform that allows users to trade cryptocurrencies directly with each other, without the need for a central authority. The exchange uses smart contracts and blockchain technology to facilitate trades in a peer-to-peer manner.

Key Features of DEX:

Decentralized control: No central authority; users trade directly with one another.

User-controlled funds: Traders retain control of their private keys and funds.

Lower liquidity: Liquidity depends on the number of active users and the pool of assets available.

Higher security: Less susceptible to hacking since there’s no central point of failure.

Privacy: Typically does not require KYC (Know Your Customer) or identity verification.

Examples of DEX:

Uniswap

SushiSwap

PancakeSwap

1inch

Key Differences Between CEX and DEX

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Control | Controlled by a single entity | Controlled by a decentralized network |

| Liquidity | High liquidity due to centralized control | Lower liquidity, depending on user participation |

| Security | Vulnerable to hacking attacks | More secure due to no single point of failure |

| Fees | Typically higher fees for transactions and withdrawals | Usually lower fees due to decentralized nature |

| Regulation | Often regulated by government authorities | Less regulated, operates globally |

| User Experience | Easier to use, more intuitive | Can be complex and less user-friendly |

| Privacy | Requires KYC (Know Your Customer) verification | No KYC required, users retain privacy |

| Examples | Binance, Coinbase, Kraken | Uniswap, SushiSwap, PancakeSwap |

Pros and Cons of CEX vs. DEX

Centralized Exchanges (CEX)

Pros:

Higher liquidity makes for faster and larger trades.

Easy-to-use interface, ideal for beginners.

Regulated: Offers some degree of consumer protection.

Cons:

Vulnerable to hacking since the exchange holds users’ funds.

Centralized control: A single point of failure.

Requires KYC which compromises privacy.

Decentralized Exchanges (DEX)

Pros:

Privacy: No KYC is required.

Control over funds: You retain control of your private keys.

More secure: Less vulnerable to hacking because there is no central entity.

Cons:

Lower liquidity, which might result in slippage.

Higher complexity: May not be as user-friendly for beginners.

Longer transaction times due to reliance on the blockchain.

Which is Better?

The choice between CEX and DEX depends on your goals and preferences.

Use a CEX if you want higher liquidity, ease of use, and don’t mind sharing your personal information (KYC).

Use a DEX if you value privacy, security, and control over your funds, even if it means lower liquidity and more complex trading.